A Guide to ROI in “sustainable” Home Upgrades

If I had a penny for every time I get asked how and when this "sustainability stuff" pays off....

Investing in the future isn't just about immediate gains; it's a commitment to sustainability and long-term value. However, I do understand that the Return on Investment (ROI) is vital. It's not mere numbers; it's about perceiving the impact of factors that shape profitability.

Let's delve into these elements, particularly through the lens of sustainable upgrades - sustainable as in reducing energy demand primarily (you know, airtightness, insulation, ventilation, thermal bridge free, condensation free, and yes maybe a solar panel or two - but remember!

Energy efficiency is the first renewable energy!

Initial Costs vs. Long-Term Savings

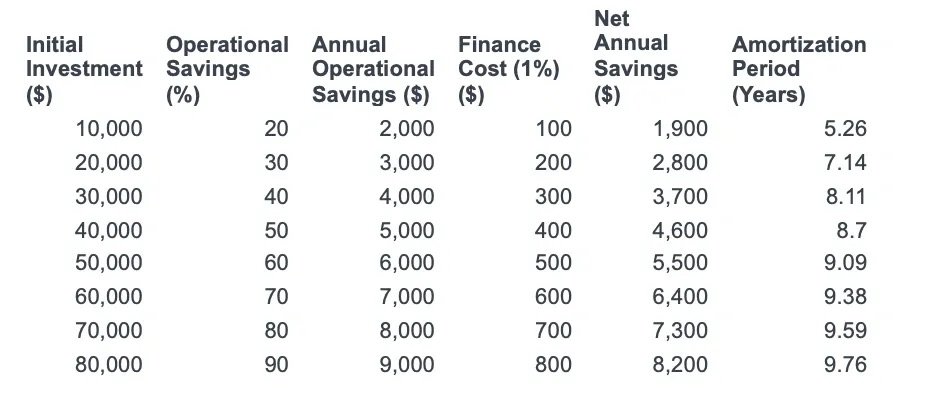

In our (simplified) example we consider residential housing, where we can observe a direct correlation between upfront costs and operational savings – a progressive leap from 20% savings with a $10,000 investment to an impressive 90% for a $80,000 investment. (background: we could show in studies that we can reduce the energy demand in buildings on average by 30% across New Zealand by implementing airtightness, and the typical upgrades to Passive House have been ranged around +15% to the overall build cost).

Amortization periods for Investements in sustainable upgrades

The breakdown is straightforward:

Operational Savings: An increase of 10% savings for every $10,000 invested.

Annual Operational Savings: A reduction in ongoing costs, directly multiplying as we step up the initial investment.

Finance Cost: A modest fee for the financial support that makes these upgrades accessible. Incredible offers currently available for $80,000 at 1%, or $50.000 for 0%!!!

Net Annual Savings: The actual yearly financial gain after covering the finance cost.

Amortisation Period: A timeline that shows how swiftly the savings will recoup the initial outlay.

Enhanced Value Through Green Living

ROI transcends the initial cash input, embodying the value it generates over time. In the realm of real estate, this could mean rental yield or augmented value from eco-friendly enhancements.

New Zealand's real estate scene has been buoyant for decades, and sustainable features are increasingly pivotal in property appraisals. Why? Here's the rundown:

Consumer Demand: The growing appetite for homes that tread lightly on the earth.

Energy Efficiency: Sustainable homes are synonymous with cost-efficiency and reduced energy bills.

Regulatory Support: A building code that's steadily turning green, favoring eco-conscious designs.

Investment Trends: The financial sector is riding the green wave, with green financing blooming in real estate markets.

The Time Value of Green Investments

The ROI of sustainable upgrades isn't instant – it unfolds over time. A prompt 10% return differs vastly from a return of the same percentage spread over years. In the New Zealand context, the bright-line property rule highlights the importance of a long-term investment horizon to maximise benefits (5 years for new builds and 10 years for others).

Inflation and Real Estate: The Sustainable Shield

Real estate stands tall against inflation. With inflation comes the depreciation of currency, but tangible assets like property often surge in value. For green property owners, this is doubly beneficial as sustainable homes may be more resilient to the fluctuating costs of living, ensuring your investment not only holds its ground but potentially grows in value.